The US Stock market entered a bear market recently, dropping -20% from the previous high which occurred on January 3rd. We’re now five months into the bear market which we know doesn’t feel good for anyone. Our Investment Committee has composed the following information for you in the hope of providing some helpful perspective on the current market environment.

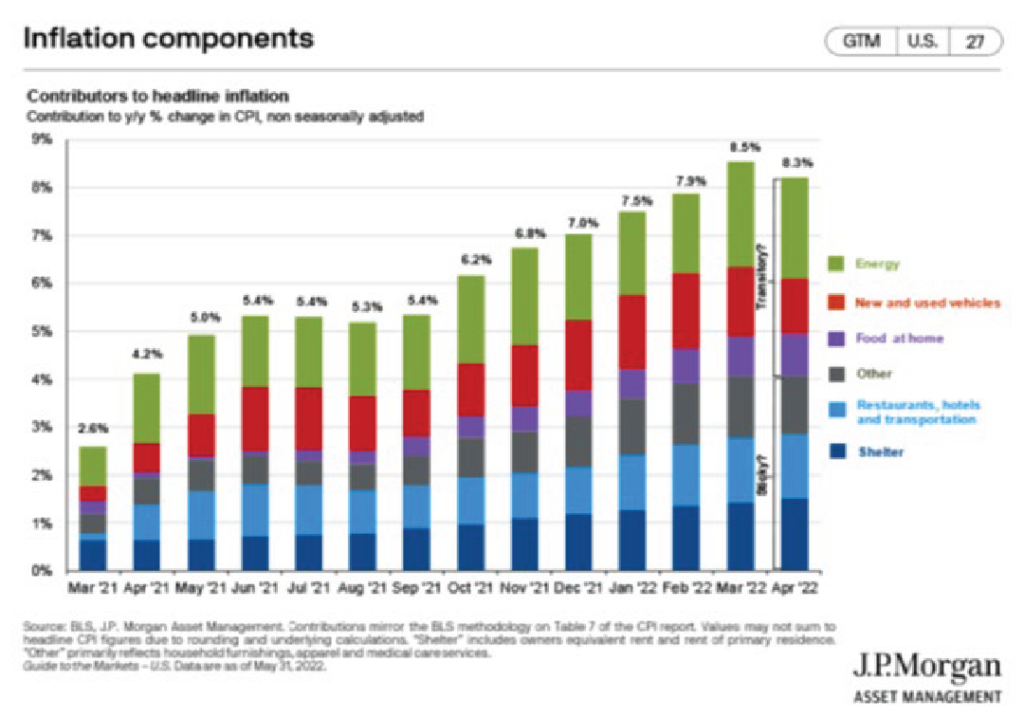

This year stock and bond markets are clearly responding to high inflation, the Federal Reserve’s effort to cool inflation with rate hikes, and the growing threat of a recession from said rate hikes.

Most recently the May inflation reading was higher than expected and the Fed reacted on Wednesday June 15th by raising interest rates by 75 bps, 25 bps more than was expected a week ago. But the market initially took that as a good sign that the Fed can tame inflation, with the S&P 500 rising 1.4% for the day. Showcasing that sometimes “bad news” is “good news” for the markets in a perverse sort of way.

Let’s look at the volatility we’ve been experiencing and what today’s realities are.

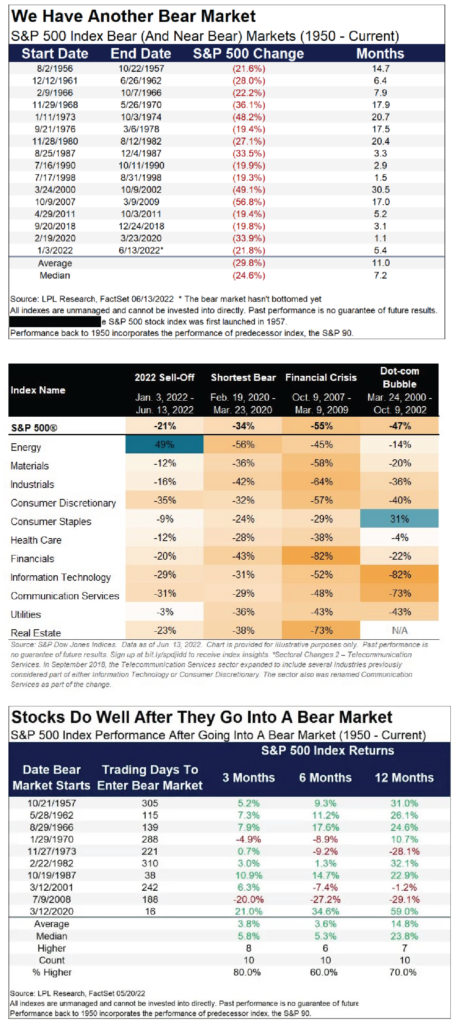

Pessimism is high, markets have been shaken, consumers are paying more for everything and for several months the Fed has been playing “catch-up”. Trying to slow inflation back to its target of 2% on average and now we’re in a “bear market” to boot! To define that term, a bear market is the “experience when securities prices fall by 20% or more over a sustained period of time.” Bear markets are also generally accompanied by possible economic downturns, widespread pessimism, and negative investor sentiment.

The nearby table highlights some recent bear markets and how different sectors performed. Sometimes they can last years, other times, like in 2020, they were over in a month with the median length being seven months.

While painful, bear markets are a natural part of investing. They are not completely unexpected, and we have been discussing the increasing probability of a recession for a few quarters now. We’d like to highlight a quote from famed value investor Shelby Cullom Davis “You make most of your money in a bear market, you just don’t realize it at the time.” He was referring to both the new opportunities created by buying quality companies at cheaper prices, as well as having the discipline to stick it out.

So, let’s dig into that a bit more. Bear markets occur more often than most realize.

As the table illustrates, we have had sixteen bear markets since 1950. The most infamous bear market occurred during the great depression from 1929 to 1932, when stocks fell 84% from their highs and did not fully recover until 1945. In the 1960’s there were two difficult bear markets as the Fed grappled with inflationary pressures during that period. In the 1970s, due to continued high inflation, an oil crisis, and the collapse of key economic agreements between nations, stocks fell about 50% from their peak in 1973. 2000 was the three- year dot-com bust, 2008 was the great recession from the mortgage crisis and then of course 2020’s covid bear.

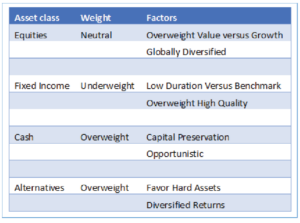

What has the Procyon Investment Committee been doing?

Over the last several quarters our expectation for continued inflation and market turbulence has risen steadily. While our portfolios have experienced a reduction in market values, we have made and continue to make changes in anticipation of the volatility. The main allocation factors in place throughout our portfolio construction and management have been the following:

While we are happy with some results, others have not protected portfolios as much as we would have hoped. Bonds have experienced the worst start to the year in decades, failing to act as a hedge for portfolios as equities fell. As an example, the 7-10 year Treasury Bond ETF (IEF) has a YTD return of -13.49%, with the 20+ Year Treasury Bond ETF (TLT) down -25.06% year to date. Over most periods of economic turbulence these widely held investments provide a risk-off ballast to a difficult equity market and will tend to hold their value – that has not been the case thus far in 2022.

We often say the markets are forward-looking and respond to the prospects of the situation getting marginally better or worse; not a straight “good or bad,” but rather how are things changing at the margin and what is our trajectory? Given what we face today there are some important investing points to consider as we position portfolios. We also tend to think in terms of probabilities of outcomes; not absolutes.

While fiscal and monetary stimulus had a role in spiking inflation, both of those are now reversing. The Fed is raising rates, reducing monetary stimulus, and the US Congress is no longer actively discussing further fiscal stimulus. While new variants of covid continue to pop up, the pandemic shock is receding, and supply chains are trending towards normal. Also on the positive side is the low level of unemployment and the increasing participation rate with workers drawn back into the workforce by higher wages.

Recently the 30-year mortgage rate reached 6%! Existing home sales are down -5.9% (a/o 4/22) versus a year earlier, and vehicle purchases have screeched to a halt just recently. While this is bad if you want to buy a new house, it will slow the housing market helping to cool inflation pressures.

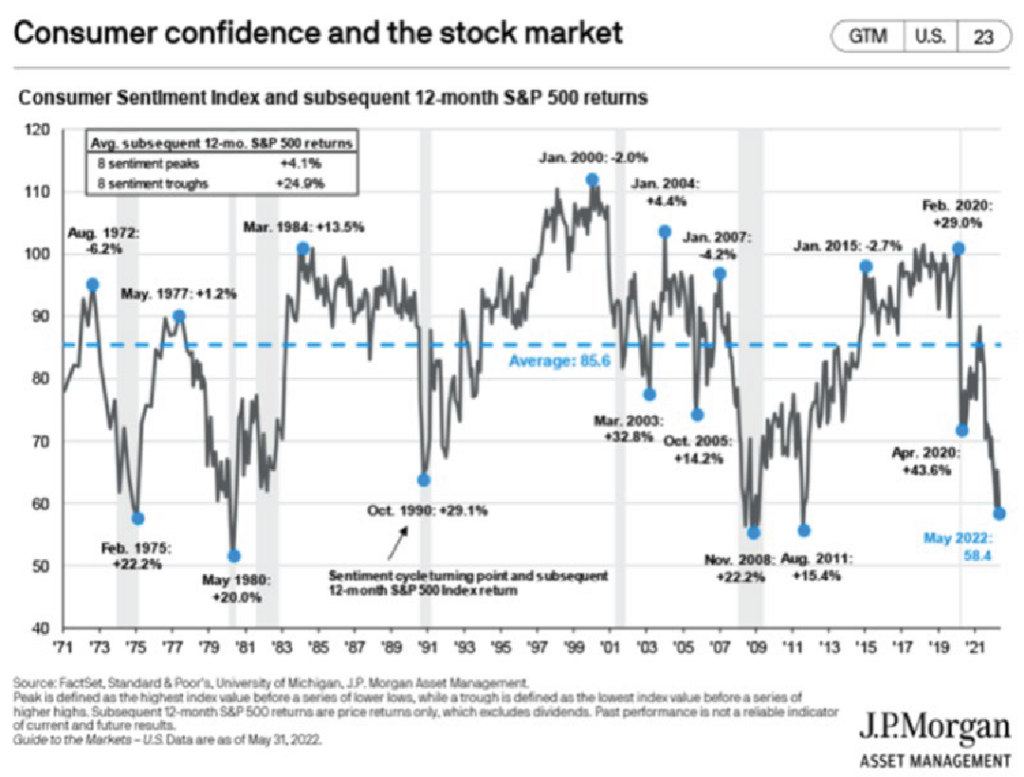

Consumer sentiment has also slipped to a trough of 58.4 (shown above). Consumer confidence metrics point to the potential for higher expected equity market returns in the future as well.

As we write this, markets are reacting positively to the rate news as they cheer on the commitment to reducing inflation by the Fed. The coming days and months will prove how effective the Fed can be in mitigating inflationary pressures, but we are confident an aggressive approach is prudent. What remains to be seen is whether they will be able to achieve their “soft landing” of slowing inflation without causing a recession.

We will conclude with a final reminder that Procyon uses a client’s financial plan as the bedrock of any investment strategy. Helping clients achieve their goals with their own individual risk appetite is important. The financial plan itself makes use of Monte Carlo statistical probabilities to incorporate these inevitable bear market slumps that occur along the way into our long-term planning.

In July please be on the lookout for our full analysis of the second quarter and a more complete discussion on the possible outcomes ahead as we see them. As always thank you for the trust and confidence; we will get through this period together. Please call us if you have any questions, concerns, or to simply talk further.