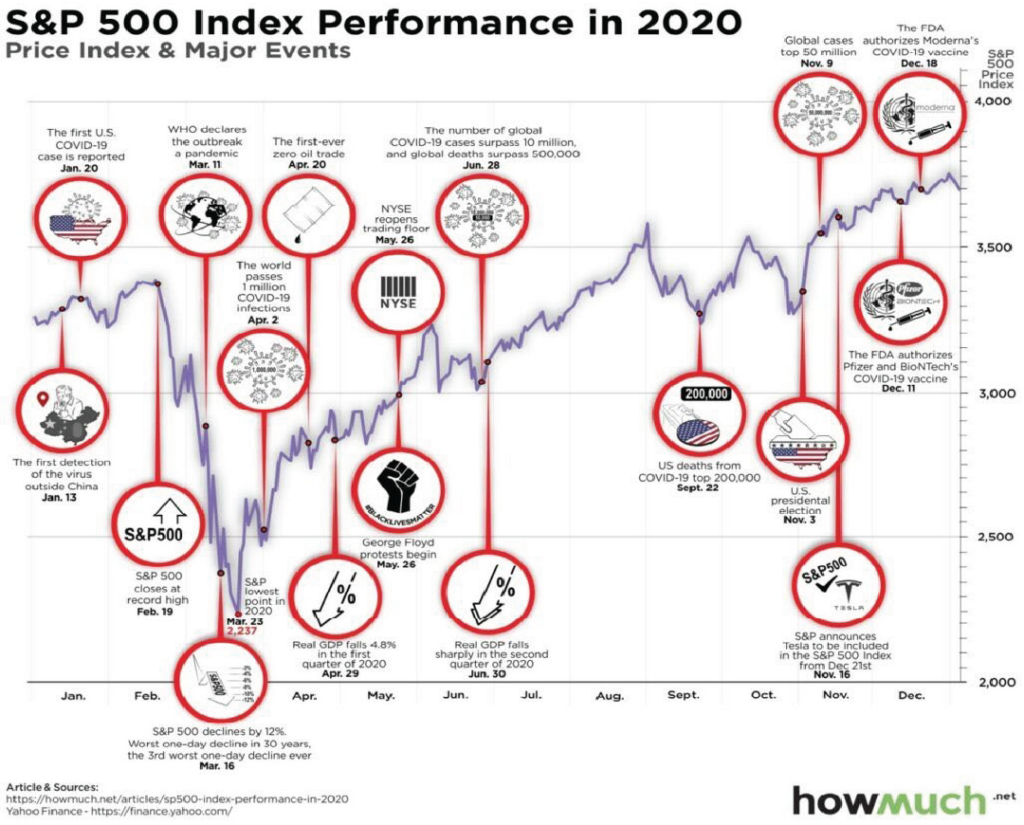

Pop culture is suggesting 2020 should have its very own history curriculum with its outsized share of historical events! The graphic below highlights a few of those events. As we complete the first month of the new year, we continue to have our share of interesting events. The beginning of a new year is typically a time to look forward as well as reflect on the year just passed. Over the course of this commentary, we will provide a summary of 2020’s events, discuss some key items from January and talk about the economic impact of vaccine development and distribution.

Market Returns

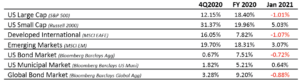

However unpredictable the events of 2020 were, the market returns were equally so. The table below illustrates how various parts of the markets performed in Q4 2020, 2020 and January 2021.

2020 performance for most of the market segments was truly remarkable, when you consider where we came from earlier in the year. On March 23rd, 2020 equity markets hit their lowest point for the year with the S&P 500 down -30.43%. It then experienced an incredibly fast recovery to reach all-time highs by the end of the year.

From March 23rd to December 31st, the S&P returned +70.18% and the Russell 2000 moved +99.05% higher. International markets experienced an equally quick, though not quite as robust, recovery with the MSCI EAFE returning +61.43% and the MSCI EM index returning +70.31% over that same time. Procyon’s investment committee worked extra hard for our clients; meeting daily during the spring and summer. 2020 again proved our guiding principle – stay the course and adjust the sails on the ship as needed, i.e., do not panic and sell equities at the worst possible time. We will undoubtedly have other storms in the future, so this is an important lesson.

January Key Moments

With equity market momentum heading into 2021, investors had to quickly turn the page into the new year as the Georgia run-off elections took place on January 4th. This was the last domino to fall in the election cycle which had already named a new president-elect and left the House of Representatives with a smaller Democratic majority. Equity markets initially responded well to the election, having resulted in perhaps a goldilocks scenario – more stimulus without enough Democratic control to pass some of the party’s less mainstream ideas. Small cap and emerging market stocks performed extremely well on the back of this result. While the initial reaction to the election results was positive, it is still too early to discern the longer-term impact of the new administration. Procyon continues to monitor any developments for potential impacts to your investments; noting that any possible Biden tax increases and their timing would be of particular concern.

As if the virus and a new administration were not enough, we also had some rare drama with GameStop and a few other companies popping up in the news recently. What we saw occur with the shares for a select number of public company’s is often referred to as a “short squeeze” and we felt as though a simplified explanation would help frame the events properly. While most investors buy a stock “long” and hope that it goes up, it is possible to sell a stock “short” where the investor makes money if the stock price falls. This is a normal function in the markets and helps ensure price discovery.

A short squeeze occurs when a shorted stock goes up causing those who sold short to lose an ever-increasing amount of money. They are then forced to go to the market to eliminate their short position by buying back the stock they shorted, helping to increase its price even more. What was different this time was the relatively new phenomena of social media apps, free trading platforms and (some) novice investors buying into a stock’s momentum narrative with borrowed funds. When a customer buys on margin they are typically using 50% of their money and 50% of the brokerage’s money to invest. When the stock moves against them, as it did dramatically in this case, the brokerage finds itself needing to pay the winning side of its client’s bets while also having their client’s default on the losing bets (not paying back the borrowed money). While any brokerage can tolerate some level of this, the extreme movement and dollars chasing just a few stocks caused the system to hiccup. As a result of this, apps like Robinhood eventually limited new purchases. This raised eyebrows and a narrative emerged that it was “little guys” against Wall Street – which is less than a complete picture. So, while the investing implications are interesting, the larger lesson we are seeing more and more is the power of people to get together online for collective action. Sometimes with a good result, other times not so much.

Economy v The Markets

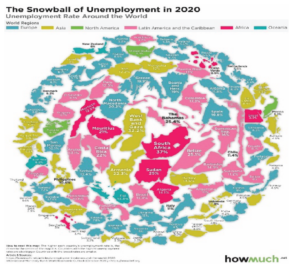

It can be quite puzzling to connect the rise in stock prices with the reality that an unusually disproportionate amount of the world’s population is unemployed because of this health crisis. We looked at why this was a nagging issue throughout most of the year and felt it was prudent to communicate some of the influences that data flow can have.

The beginning of the recovery for the markets in 2020 began in late March and early April almost exactly as weekly unemployment claims peaked in the US as shown below (image 2). However, at the time, it seemed almost the opposite was occurring; the markets were rising while unemployment claims were reported in arrears and still accumulating. The number of weekly unemployment claims have steadily declined since the market bottom.

As we have learned throughout this past year, our behaviors can be influenced by our expectations and the timing of that data flow can often influence those expectations as well. When evaluating markets and unemployment trends, we must remain cognizant that market data is live and employment data lags, thereby creating this effect that influences our expectations, especially at a moment in time when all investors are seeking more data than is available. Said another way, the markets are focused on what is likely to happen six – nine months from now and less on today’s headlines. The markets are not discerning whether these statistics are “bad” or “good”, but instead they are evaluating the rate of change going forward – is it getting worse or is it getting better?

Covid

We now have multiple effective vaccines approved for use that are in the initial stages of distribution with varying degrees of distribution will be important for both global health and global markets.

While projections are fluid, the US is about 10% vaccinated and broad projections suggest reaching critical mass by the end of Summer. All eyes are watching Israel which at 58% is the most vaccinated country in percentage terms while most of the remaining world remains under 10%.

New, more easily transmittable variations, while expected, are also raising new questions for the medical community. The path does not appear to be a straight line unfortunately. The clearest path to full economic recovery, albeit a scarred one, would be the full adoption of a safe and tested vaccine.

Building Bridges

Building bridges is a theme we are seeing from several different perspectives at this point, both literally (through potential increased infrastructure spending domestically) and metaphorically (whether both political parties can work together for the greater good). Aside from the acute issues associated with contracting the virus, there is no doubt there will be long-lasting effects on our society. However, long- lasting does not mean forever and 2021 is the year in which we hope to see which changes are transient and which are more enduring.

Download PDF BACK