“Summer will end soon enough, and childhood as well.” George R. R. Martin

Labor Day, Back-to-School and Some Normalcy?

We do not know if you are fans of the hit HBO series Game of Thrones, but the quote from the show’s creator seems apropos today. While he wrote a captivating show, he was famous for killing off major characters the audience loved. A friend once described the show to a new viewer succinctly as “bad things happen to good people.” That feels like us as we collectively deal with this pandemic—bad things happening to good people!

As we prepare for Labor Day this weekend, we have been reflecting on the significance of this holiday. Normally it is filled with joyful picnics, large barbecues, family, and friends but we realize that it will be different this year. We all had been hoping that things would return to normal sooner rather than later, but it just does not seem like that is in the cards, at least in the short term.

While the COVID cases in the US have declined from the early summer rise, further spikes seem inevitable as students return to school. Hopefully, the variety of online, in-person and hybrid models that schools are trying will be able to be carried out successfully. Everyone seems to agree that protecting our loved ones, facilitating a healthy economy, and avoiding a second economic lockdown are all critical.

As the summer ends there are three themes that immediately come to mind including the growing anticipation of the US elections, Congress’s fiscal policy impasse and the US Federal Reserve’s decision to alter its view on inflation.

To address the first, we will be issuing a special Procyon Perspectives election commentary in mid-September discussing the upcoming elections and various possible outcomes. We will acknowledge, however, that virtual conventions and issues ranging from the legitimacy of social media political campaigns to the integrity of the voting process have saturated the news. The lead Joe Biden has in the critical swing states still exists but has narrowed while the battle for control of the US Senate remains as hot as ever.

The second prevailing theme is that Congress has failed to reach an agreement on any further fiscal stimulus which has been placed on the back burner for now. Stimulus passed earlier this year has the 2020 budget deficit approaching $3.5 trillion, and the national public debt (approximately $19.5 trillion) is set to exceed 100% of GDP (approximately $21.5 trillion) for the first time since the end of World War II. It was not so long ago, only in 2007, that US government debt was 35% of GDP. While not an imminent problem today with the Fed printing away and keeping interest costs down, someone will have to pay the bill when it eventually comes due.

The third major event occurred at the virtual Federal Reserve Jackson Hole meeting earlier this month. You may recall the Fed has two mandates: maintain maximum employment and price stability. After their recent meeting, they announced a shift in their inflation target. Previously they wanted to limit inflation to 2%. Now they will hold the 2% goal as an average over a full cycle. Said differently, if inflation runs below their 2% target for a period, they will allow it to run a little “hot” and higher than 2% to compensate. This is somewhat about the balance between Capital and Labor. Higher inflation would help those with debt (including the US government) as one can repay the debt with less valuable dollars in the future, but this hurts savers and those on a fixed income without the means to increase their income as items needed get even more expensive. The Fed also made it quite clear that they will hold rates very low for the foreseeable future.

Now enough of the depressing news – let’s turn to the good news! As we like to say, “Summer is an attitude not a season!”

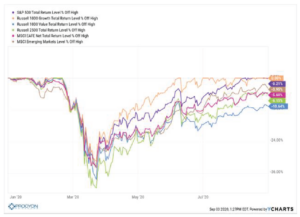

The S&P 500’s +7.19% return was the 7th best August on record since 1928! That puts the index into positive territory for the year at +9.74%. The developed international markets were next returning +5.14% for the month but still down -4.24% for the year. Emerging markets were up +2.21% for the month and now positive for the year at +0.45%.

As we have mentioned for a while now there has been a small number of companies leading the performance of US equity markets. Growth continued to outpace value during the month, +10.32% vs. +4.14%. Year to date growth has materially outpaced value equities by over 39 percentage points as growth is now up +30.47% year to date. March 23rd continues to represent the S&P 500’s lowest point this year with the index up a dramatic +57.74% off the low.

As is usual, stocks and bonds moved in opposite directions in August with bonds falling slightly. The BbgBarc US Agg Bond Index fell -0.81% and the BbgBarc Municipal Index fell -0.47% in August. The two are now up on a YTD basis by +6.85% and +3.31%, respectively. High yield fixed income was up +0.98% for the month and only +0.75% YTD as it was hurt significantly when markets sold off earlier in the year.

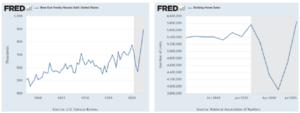

Investors’ enthusiasm was lifted by economic data pointing to solid, though moderating, growth in August and a better-than-expected second-quarter earnings season. High-frequency data, such as travel and navigation app usage, point to continued global growth over the third quarter, albeit at a more moderate pace, particularly in the US. As shown below, both new home sales and existing home sales are rising at a rapid pace with mortgage interest rates at all-time lows as well as the work-from-home trend running its course. These developments will likely lend themselves to multi-year growth in consumption, residential home value increases in many areas and the reduction in the risk for a concentrated resurgence in densely populated systems. While this is terrific for new areas of growth and development, low interest rates will likely prove difficult for fixed income investors for some time.

Markets will ultimately need to digest the economic and political risks that are beginning to weigh on the progress of our economy. We believe a stimulus package ultimately will be passed; however, our base case assumption builds in a fair level of political drag. It is likely that as the pressure mounts, we may see volatility increase into Autumn and the US Presidential debates. We remain cautious as our investment committee carefully considers our path forward.

Moving through the next stage of the pandemic reminds us of how long we have been doing this—since March! People are returning to work, they are returning to school, they are changing neighborhoods and adopting new technologies in their lives; so there is some routine to this “new normal”. While not all of us are there yet, it is clear to us that there is a willingness to adapt and to live within our new reality. As your financial advisory team, we are not intimidated by this new reality; we recognize it for what it is and continue to be passionate about seeking out innovative opportunities for you in this new paradigm.

Our team is committed to prudent action on your behalf—we continue to monitor the progress of the economy, financial markets and will continue to make changes to our allocations as opportunities present themselves.

We will leave you with a quote from Thoreau to help keep a little bit of summer with you always.

“One must maintain a little bit of summer, even in the middle of winter.” Henry David Thoreau

Download PDF BACK